I've been having fun with charts again.

It's good that the charting is fun, because the information isn't so fun.

I believe this is what my friend Nancy refers to as "the horizon always receding":

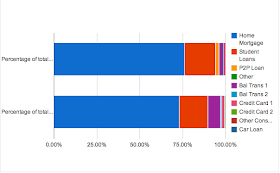

This chart represents the changes--both subtle and, ultimately, virtually nonexistent--in my debt load since May 2011. The top bar is last year, and the bottom is now. So to speak.

You see, I've reduced my overall debt by about $7,000, which is nothing to sneeze at. But in real terms, I've made neither net gains nor losses overall. The biggest chunk paid down was on my house mortgage, owing to this helpful scheme. My student loans have shrunk, too, by another $2,500 during the past year.

The big growth is in credit consumer debt, but the picture is not as dire as you may imagine. More than 75 percent of my current credit card debt is actually sitting on balance transfer cards, not accruing further interest. My credit is costing me less than it ever has.

I've finally paid the last of my $5,000 loan to The Lending Club this month, and I am refinancing my house at a lower interest rate, which will help me pay a little more toward credit cards. I have managed to incur no additional debt during the past six months in spite of several major expenses, including a big 13th birthday party for my daughter and travel expenses associated with a couple of professional conferences, plus some major repairs to car and home.

Yes, delightful. But at the end of the day, I am frustrated, my fellow CheapBohemians. Because basically all this means that I am just winning at running in place.

It's good that the charting is fun, because the information isn't so fun.

I believe this is what my friend Nancy refers to as "the horizon always receding":

|

| (Click the chart for a better view.) |

You see, I've reduced my overall debt by about $7,000, which is nothing to sneeze at. But in real terms, I've made neither net gains nor losses overall. The biggest chunk paid down was on my house mortgage, owing to this helpful scheme. My student loans have shrunk, too, by another $2,500 during the past year.

The big growth is in credit consumer debt, but the picture is not as dire as you may imagine. More than 75 percent of my current credit card debt is actually sitting on balance transfer cards, not accruing further interest. My credit is costing me less than it ever has.

I've finally paid the last of my $5,000 loan to The Lending Club this month, and I am refinancing my house at a lower interest rate, which will help me pay a little more toward credit cards. I have managed to incur no additional debt during the past six months in spite of several major expenses, including a big 13th birthday party for my daughter and travel expenses associated with a couple of professional conferences, plus some major repairs to car and home.

Yes, delightful. But at the end of the day, I am frustrated, my fellow CheapBohemians. Because basically all this means that I am just winning at running in place.

But has the total shrunk? I shall take up the cudgel of your challenge, m'lady, and send you my own progress or lack thereof, and I'll wager a wineskin that I can come up with a niftier chart.

ReplyDeletePS Can you tell I've become obsessed with Game of Thrones? Cheap entertainment, at least until I rip through the last 800 pages, of roughly 5,000 pages total.

Well, yes, there's been a net reduction of that $7,000 from the bottom line.

ReplyDeleteYou are my designated chartmaker. I'm no good at that stuff.

Also, I'm reading Proust, so i'll race you to the end.

I'm trying to figure out how to paste my nifty chart.

ReplyDeleteI got serious about this in February 2011, when my church started a "money fast" for Lent, and I thought I could pay off the credit card debt in two years. Since then, I've reduced my credit card debt by over $10,000, from almost $27,000 to just over $16,000. While paying down parent loans at the same time. Unfortunately, the second-year loan for the third kid hit the books during this time period, so the overall debt went down hardly at all, and I have two more $9K-$10K loans to come the next two years. My goal is to pay off the credit card debt in two years [sound familiar?] so that I can then tackle the parent loans, which have ten-year schedules unless I do something about them.

By the way, my retirement horizon is fifteen years, and I'm only making token contributions to the 403b, 1/7 of the maximum tax-deferred. I rent, not own, no mortgage or car payment.

I'll email you the chart, if you want to post it.

I got it! You want me to post it? I actually do see the good news in it. I mean, come on...$10,000 net reduction in credit card debt is impressive while paying student loans for more than one child.

ReplyDeleteI wonder why we all seem to choose "two years" as our horizon.

I think your chart--hell, any kind of attention paid--is inspiring for all of us.